Getting Better All The Time

That which is measured improves...

I’ve had quite a few sign-ups since my last post a few months ago. Thanks for your free vote of confidence! If you found this helpful, check out my timeless backlog on https://www.savagecorner.io and please forward to a friend. If this was shared with you, please hit the subscribe button for very occasional but priceless content!

How are you doing? Many of my followers are deeply involved in Terra and have fat LUNA stacks, so you’re probably doing great. The rest of you could still be down 30-40% from your portfolio highs…

But how do you know?

Track Your Performance

Whenever you trade, it’s important to regularly track your results against your expectations. Are you performing as you hoped, and how are you performing relative to the market you’re trading within?

I am religious about tracking my overall performance, updating all my accounts in a spreadsheet every week so that I have a clear picture of what is happening in my portfolio.

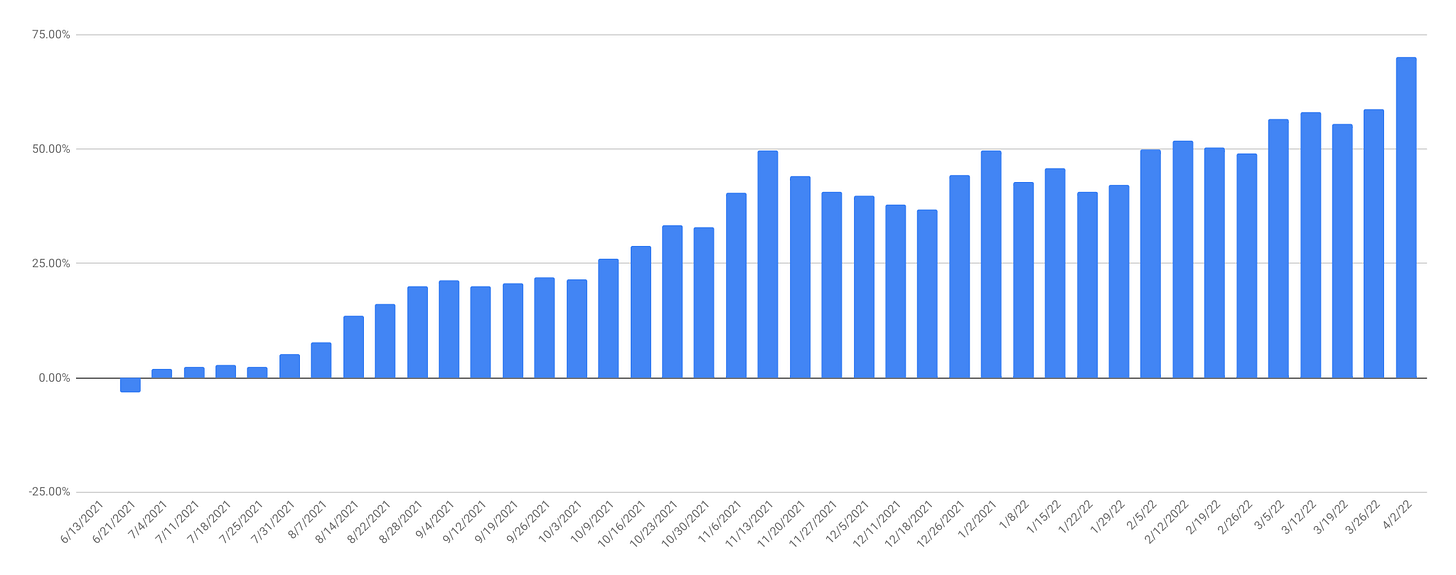

Looks pretty good, right? This is my portfolio level performance, starting one month before I went full time as a crypto trader and sometimes writer.

Break It Down

But wait… what’s happening here?

The stellar results across the rest of my assets were hiding a critical issue with this trading strategy. I need to evaluate what is happening with this strategy to determine whether it’s a temporary issue (great strategies sometimes perform poorly) or a permanent issue (strategy has no edge). If there is no edge to the strategy, then I need to either find a new strategy for these accounts or reallocate to better strategies.

Take Action!

Now that I know there is a problem, I can take action to improve my results in these accounts. Are you doing the same for your portfolio?

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Savage Corner writers hold crypto assets and actively trade in certain markets.

Never mind my comments just below. I haven't followed your webpage, and didn't realize your sophisticated allocation strategy. I'm used to talking to novice, or first time investors.

Please excuse my take on the first post I have seen from you in a while.

Please mark me as an avid follower, so I can see what you're doing!

Obviously, your last post focused on a single holding that's not performing well. That happens to well capitalized, well run companies/protocols lots of times.

Buy the dip?, comes to mind, if you really believe in the long term viability of this 'chain. Or, sell out of the money puts, and wait for them to expire, a bit of cash in hand.

Personally, I don't like the Options Market, in traditional finance, as I'm more investor than trader.

What you"re doing is trading strategy in the blockchain universe, which is very attractive, but again, not my style.

Keep me in your loop, as I love reading about what you're doing!

Somehow, I got kicked off your webpage. So, to continue, you need to diversify your portfolio. Lots of choices, now, that crypto is being figured out by the Gov, Big Business, and mainstream world investors.

Every investment period, choose something new to you, that excites you, something you think you could help develop. Buy just that periods allocation to that protocol. Fractional shares, still add up!

My portfolio is suffering, as well as yours, due to my propensity to favor new technologies, so I'm holding my best convictions for the long term, until I fall below my sell stops. I use net worth as my backstop, you probably bought Terra/Luna as part of a developers package, so, free money! Don't give it away.

If the Wright brothers had caved to normal sentiment, we wouldn't have airlines now.

What are you looking to do?

BTC/ETH conversion is already mainstream, Terra/Luna is a great protocol, as far as I can divine.

Have you considered developing in the Metaverse space? Enhancing the audio/visual of current Metaverse space would be a godsend, who needs to see 80's tech in the 2020's?

So to recap:

Continue developing

Diversify your portfolio, Stocks, Bonds, Cryptos

Diversify your expertise in varying protocols

Continue HODLing your blockchain returns.

Best, Uncle Jerry