Is It Priced In?

. . . because markets are efficient, nothing is ever priced in

This is a controversial statement! Nothing is ever priced in? What does it mean? I’m going to explain how expected value can be used to evaluate financial opportunities, and then demonstrate how shifting probabilities result in a world where nothing is ever priced in.

Expected Value

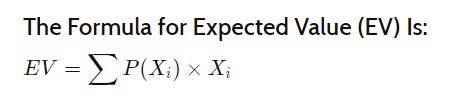

When you have a range of scenarios with varying probabilities of likelihood, the expected value can help you evaluate whether something is worthwhile.

Investopedia defines expected value as ‘an anticipated average value for an investment at some point in the future.’

Well, that’s an eyesore! Simply put, you multiply the value of an outcome by the probability of that outcome occurring.

In the simplest example, imagine being challenged to a coin-flipping contest. You examine the coin and decide that it’s a ‘fair’ coin with equal probability of heads versus tails. For each coin flip, you put $1 into a bowl. If you flip heads, you win and get to take out $2, but if you flip tails, then you lose.

There is a 50% likelihood of total loss. There is a 50% likelihood of earning $2. The total expected value is ( 50% * $0 ) + ( 50% * $2 ) = $1

Since it would cost $1 to play, it could be a fun game (stop when you’re ahead!) but over long enough play, you’re not likely to earn anything. But what if you could play for $0.99? In that case, you would earn an average of $0.01 per game over a large enough number of games (this is how casinos make their money)!

You still need to think about proper bankroll management to avoid risk of ruin, but having a positive EV relative to the cost of each play means that you are likely to make money over time!

Shifting Probabilities

When economists claim that markets are efficient, they are claiming that all known information is factored into the price. In effect, the claim is that the probabilities are known, the values of outcomes are known, and the market price perfectly matches the expected value. Okay, sure. . . I think we all know by now that people are not so efficient in their financial decisions, and move as a herd to adjust probabilities and expected outcomes.

Even if were actually true for every possible moment in time, the probabilities of different outcomes are constantly changing, which can explain why market prices are constantly changing!

When key news items come out, the probabilities change dramatically. As I am writing this, we live in a pre-merge world for Ethereum. One could imagine the price as factoring in the probability of a successful merge, with some expected outcome value, along with the probability of the merge failing (or being postponed), with some expected outcome value. When the merge eventually occurs, the probability of further postponement will reduce to zero, and the probability of failure will also reduce steadily (there is a critical window right after the time of merge where the probability is still non-zero). It is unlikely that the humans evaluating the merge’s success/failure will update their models as quickly as the real probabilities are updating, so the shifting probabilities mean that the merge will not be priced in, even for a short period after its successful conclusion.

This same reasoning applies to all news events… and crypto is a fast-moving space, with a lot happening really quickly and no universal news coverage (though some have tried).

So Is It Easy?

If nothing is priced in, it is always possible to get an edge. You just have to have more accurate probability and outcome models than the market as a whole. That means staying informed, being nimble, finding the news sources that keep you ahead of the market. It means having solid mental models but also questioning them continually, poking at them for weaknesses, acknowledging your errors (Terra, oops!) and searching them for lessons. It means knowing when you are at your best and when you should be avoiding major decisions. Successfully managing an active portfolio is a full-time job!

Not everybody should be an active trader, speculator, or investor. If you’re not willing or able to do the work then passive strategies will serve you well. If you are willing and able, then the crypto markets are full of opportunities! I plan to keep writing about how to make the most of these opportunities. Please subscribe to learn from my experience.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Savage Corner writers hold crypto assets and actively trade in certain markets.