Yield Dollar: What? How?

To fully appreciate yield dollars, we’re going to start with a quick review of simple & compound interest. Then we’ll explain yield dollars and then give a few different DeFi examples from different crypto ‘ecosystems’.

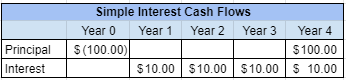

Simple Interest

Simple interest is pretty straightforward, and it will likely be familiar to you. Imagine you’re lending somebody $100 for four years at 10% interest. They agree to pay interest of $10 each year and then repay in full at the end of the third year. At the beginning of the period you send them $100 (cash flow out). At the end of years one, two, and three they send you $10 interest (cash flow in). At the end of year four, they send you $10 interest, plus the $100 principle (cash flows in).

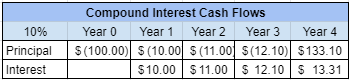

Compound Interest

This is where money starts to get interesting. Instead of an individual loan, imagine it’s an interest-bearing account, so you can reinvest the $10 each year. After the first year when you receive $10, you deposit that into the account. Now you have $110 working for you instead of only $100, so at the end of the second year you get $11 interest instead. After depositing that, you have $121 working for you, so at the end of year three you would receive $12.10 interest. Deposit that too, and you now have $133.10 working for you. Now at the end of year four, you receive $13.31 interest and get back your new principle of $133.10. Instead of receiving total interest payments of $40 over the four years, you have received interest payments of $46.41!! The extra $6.41 is from compounding the interest.

Incidentally, if these were quarterly payments over a year instead, then this would represent an APR of 40%, but an APY of 46.41%, as their only difference is whether the earnings are compounded. I consider the use of APY for anything in DeFi to be disingenuous because the APR’s are based on very temporary underlying conditions. There is little likelihood of being able to compound a DeFi APR for an extended period… unless the total return is powered by the programmatic appreciation of the token instead of driven by regular cash flows.

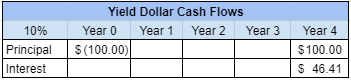

Enter the Yield Dollar…

Instead of regular interest payments, suppose that the increasing value is kept (and still compounded) in the account. You’re investing $100 up front to receive a total value of $146.41 in four years. For each dollar that you will receive in four years, you’re paying a discounted price of $0.683013 now. If this is enforceable in some way (via contract or smart contract), or reliable from start to finish it’s now a yield dollar. You pay a discounted price now for each dollar you will receive later. There are no cash flows, and the yield is internalized (imputed) into the going rate for the asset.

In traditional finance, yield dollars are usually specific term instruments, issued by governments. The best example would be the short-term treasury bill auctions. In effect, the treasury is selling dollars that will be delivered in three months, and buyers bid on those dollars. It’s a dutch auction, and the settlement price is the highest price (lowest discount) that buyers are willing to pay. If they were willing to pay par (full value) for each dollar, then it would be a 0% interest rate, and if they were willing to overpay for each dollar then it would be negative interest rates!

In DeFi, yields can be established by using token settlement dates and a trading market, or by having a smart contract that calculates a steadily rising reference price and regularly issues (and liquidates) tokens using the reference price. Let’s look at some examples.

UMABILLS

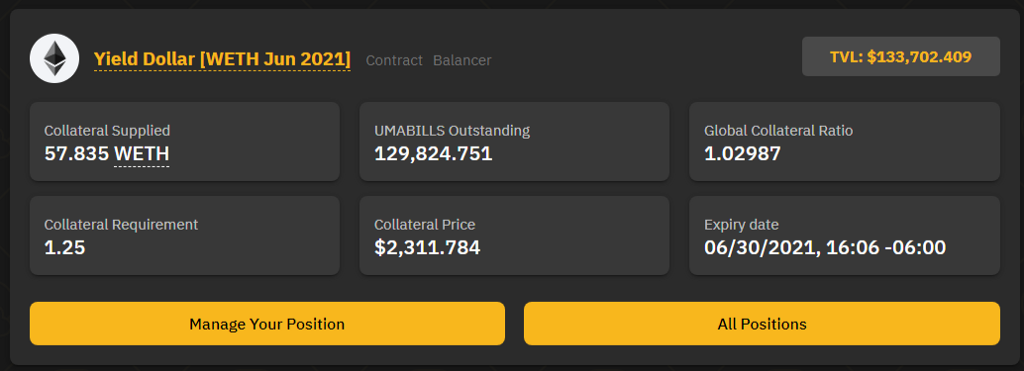

UMABILLS are built on the UMA protocol. UMA protocol is built on the Ethereum blockchain. It allows you to lock ETH or BTC collateral to mint UMABILLS and sell them into their established Balancer AMM pools. Yield farmers can earn BAL and UMA rewards for providing liquidity to the AMM pools.

UMABILLS have a specified maturity date. On the maturity date, the UMA protocol queries its governance for the prices of ETH and renBTC, and sets the UMABILLS token to be backed by specified amounts of ETH or renBTC (exactly $1 worth at settlement…) The tokens can then be redeemed at any point for the specified amount of ETH or renBTC that is established at settlement. Issuers can either buy their own back from the market to redeem or just cash out the rest of their collateral and leave the fixed amount required to back each token in the smart contract. After the settlement date, the tokens will be worth whatever $1 of their backing asset from that date is worth, and won’t be yield dollars anymore.

With yield farming available for UMABILLS, they sell at a premium (negative interest rates), since participants can earn more from the yield farming than they pay in the imputed interest. This means that issuers can borrow at negative rates by minting and selling the UMABILLS at a premium, then repaying the loan at the settlement date. The imputed interest here comes from the premium paid by yield farmers that want to hold the yield dollar without having to mint it.

There is smart contract risk, along with market risk for the collateral under this scenario, but minimal market risk for the borrowed asset, since it will reliably settle at $1 on the settlement date.

aUST (Anchor Protocol)

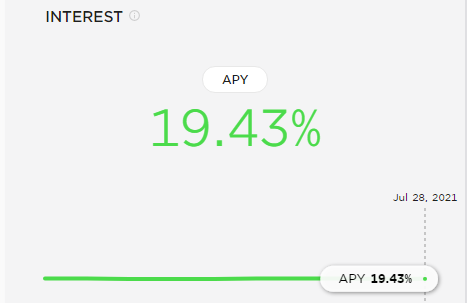

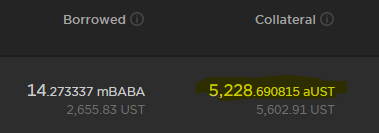

aUST (anchor UST) is issued by Anchor Protocol, a money management tool on the Terra Blockchain. Users deposit UST, a native “stablecoin” of blockchain that is algorithmically pegged to the U.S. Dollar. Anchor Protocol uses a reference rate, governed by the smart contract, to mint a specified number of aUST equivalent to the value of the UST that was deposited. Anchor then checks the wallet of any users connected to their UI and displays the UST value of their aUST token holdings, which is updated regularly as the reference price is gradually changed to impute the interest rate set by the protocol governance (typically 18–20%).

Since the interest is imputed by the reference price, you don’t have to keep holding the token in your wallet. Two weeks ago I published about Mirror Protocol, which mints collateralized synthetic assets. aUST is one of the approved collateral types. This is quite popular in the Mirror community, as collateralizing with an asset that steadily increases in value (due to the imputed interest yield) makes it a lot easier to manage your collateral requirements over time.

For aUST to meet redemptions back into UST on demand, it needs to have sufficient UST in its vaults, and the UST it holds needs to grow as the reference price of aUST increases. The UST that covers yields comes from three sources:

First, users can ‘bond’ the LUNA token into Terra Protocol’s distributed proof of stake (DPOS) governance — this stakes it to participating governance nodes, and the 90% of the LUNA earned from staking feeds into Anchor Protocol vaults to support the aUST yields.

Second, bonded LUNA (bLUNA) holders can take collateralized UST loans against their bLUNA, and pay interest that supports the aUST yields. These are subsidized by yield farming rewards for borrowers, so there is steady demand even at high interest rates.

Third, Terraform Labs has occasionally injected capital into the aUST vaults to support a higher yield. While an attractive yield is good for the growth of the protocol, it results in higher inflation rates for ANC. Since these capital injections are technically ‘third-party’ they cannot be relied on as a continuing source of yield. I fully expect Anchor governance to reset the yields from their 18–20% band down to 15% or lower eventually.

While the user experience of staking UST for aUST and earning yield by reference price increase is much friendlier than UMA’s user experience, the machine under the hood is much more complicated. There are additional economic and smart contract risks due to this complexity.

Finally, Terra blockchain and many of its applications are all built by Terraform Labs (TFL), and this developer centralization potentially makes Terra less anti-fragile than Ethereum. Their collection of pegged stablecoins had their pegs challenged during the last crypto crash, but the tokenomics held and the stablecoins kept their value within a flexible range. LUNA, the native token of Terra, has come up more than 100% since then. This price appreciation further strengthens the family of stablecoins that rely on it.

Hive Power (mvests)

While the first two examples are oriented around USD values, so the ‘yield dollar’ name feels more relevant, my final example is algorithmically linked to a native token instead of a stablecoin! That means it will have market risks instead of peg risks, but it’s still a very interesting application of yield dollar mechanics.

Hive blockchain forked from Steem blockchain in early 2020. Conceptually, everything I write about it will also apply to Steem blockchain’s native Steem Power. The specific numbers will of course be different!

The protocol has a fully integrated ‘layer 1’ blogging platform, while also supporting storing JSON on the blockchain. The JSON integration allows for smart contracts and NFT-powered games to be built using JSON, with their own separate decentralized ‘layer 2’ governance system.

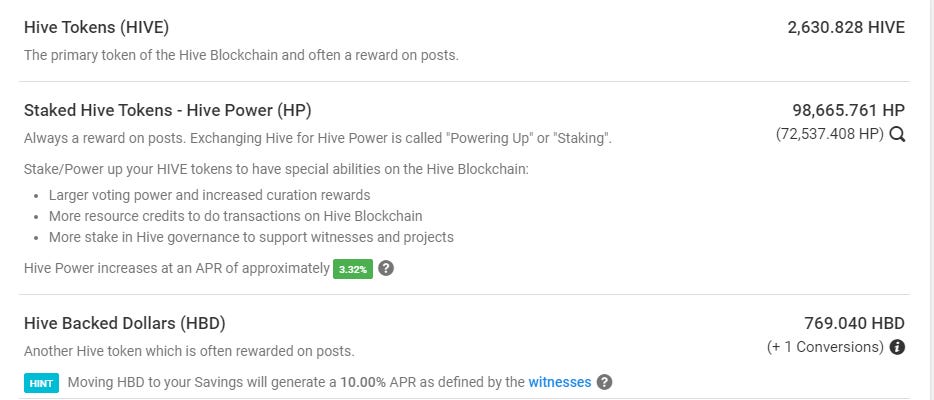

Hive has three native tokens integrated into its ‘layer 1’. The first is HIVE, a freely transferable and tradable token. Second is ‘hive-backed dollars’, a stablecoin that is minted as protocol ‘debt’. Third is ‘vests’, usually referred to as mvests (mega vests, because the actual numbers in play are really high) and colloquially referred to as ‘Hive Power’ or HP.

When Hive is staked into governance (“powered up” from HIVE to HP), the native HIVE is effectively destroyed, and the users hold mvests instead. mvests are non-transferable, but their participation in content governance (curation) can be delegated. HP can be powered down over an extended 13 week period (this was shortened to only 4 weeks on Steem shortly after the fork creating separate blockchains). When HIVE is converted to or from mvests, the transactions are governed by a reference price that steadily changes over time (HIVE per mvests in the table below).

The imputed yield earned by these yield dollars is funded by the native inflation of HIVE, and is quite low. The 1500 vesting reward percent shown in this table represents 15% of total HIVE inflation. Total inflation gradually decreases over time but is currently about 7.5%. That leaves only about 1.11% base yield for holding mvests. Since HP is only a representation of the current HIVE value of mvests held, users see this yield as a gradual increase in the HP shown on their accounts.

I included Hive Power for its yield dollar characteristics, but the earning power of HP comes from participation in content curation. 65% of inflation is earmarked to content rewards, and half of that goes to curation. An HP holder actively engaged in curation can expect a base yield of 1.11% from yield dollar and 2.44% from curation.

And here’s the kicker — only HIVE that is ‘powered up’ participates in these rewards. That means participants also receive the yields from non-participating HIVE — which provides a multiplier to these base values. At present only 34% of HIVE participates (see table above), so the 1.11% yield dollar nearly triples to 3.32%, and the 2.44% curation base is closer to 7.17%. That’s over 10% combined, funded by an inflation of only 7.5%, because so much HIVE opted out of participating!

Since this is a ‘layer 1’ token, it is not subject to any smart contract risks, which is why I find it so interesting. However, it is subject to governance risks. Hive’s witnesses have the authority to establish consensus for changes to governance-level parameters. They recently strengthened the tokenomics enforcing the HBD peg, along with making several changes to how the content rewards (curation) system works.

Conclusion

I consider yield dollars to be one of the more interesting developments in DeFi. Each approach to building a yield dollar has its own tokenomics and distinct risks, all seeking the same goal of relatively low-risk reliable yields.

My goal is to boost your understanding of what yield dollars are, and share some examples that may prove to be valuable opportunities. To help you evaluate whether each example has a place in your portfolio, I have described where the yields come from for each example and given an overview of some of the risks involved.

Check out these three projects. Then if you found this to be beneficial, follow my newsletter and share your thoughts & comments!

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Savage Corner writers hold crypto assets and actively trade in certain markets.